Montage Gold Enters Into Strategic Partnership with Sanu Gold Given Its Highly Attractive Exploration Properties in Guinea

HIGHLIGHTS:

- Montage to obtain a 19.9% ownership stake in Sanu, through the issuance of 2.3 million basic shares equating to C$5.5 million

- Lundin Family co-invests to obtain a 10% stake in Sanu, joining AngloGold Ashanti who obtained a 14.0% stake in Sanu in September 2024

- Sanu appoints Martino De Ciccio, CEO of Montage, as Non-Executive Chairman

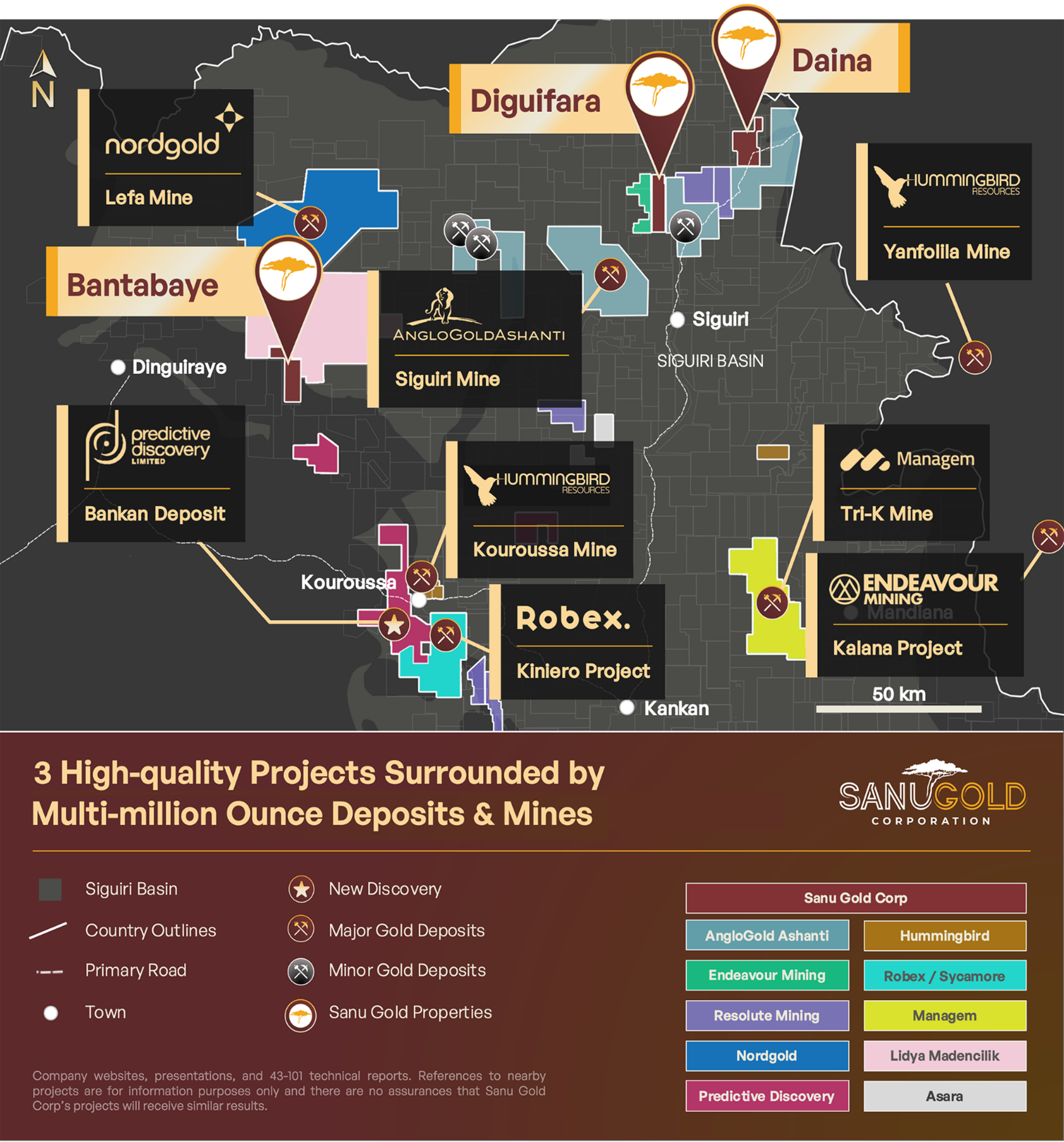

- Sanu owns three exploration properties located in Guinea’s highly prospective Siguiri basin

- Daina property, located contiguous to properties owned by AngloGold Ashanti along the same trend, hosts a high-grade gold discovery which spans over 10km along strike

- Diguifara property, located near AngloGold Ashanti’s Siguiri gold mine and adjacent to tenements owned by Endeavour Mining, hosts an over 8km long mineralized corridor

- Bantabaye property, located in proximity to the Nordgold’s Lefa gold mine and Predictive Discovery’s Bankan gold project, hosts a large mineralised system within a highly attractive structural setting

- Sanu’s equity placement will provide additional funds to supplement the ongoing 10,000-meter drill programme

VANCOUVER, British Columbia, Dec. 02, 2024 (GLOBE NEWSWIRE) -- Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU, OTCQX: MAUTF) is pleased to announce that it has entered into a strategic partnership with Sanu Gold Corporation (“Sanu”) (CSE: SANU; OTCQB: SNGCF), given its highly attractive exploration properties in Guinea, obtaining a 19.9% interest in Sanu through the issuance of 2.3 million basic shares of Montage equating to C$5.5 million, joining existing strategic investor AngloGold Ashanti Plc (“AngloGold Ashanti”) who acquired a 14.0% stake in Sanu in September 2024.

Montage will be investing alongside the Lundin Family and their associates (“Lundin Family”) who will obtain a 10.0% interest in Sanu by participating in the non-brokered private placement (the “Offering”) with an investment of C$2.7 million. Through the Offering, Sanu will obtain aggregate gross proceeds of approximately C$10.0 million based on a share issuance price of C$0.072. Montage management and certain insiders also intend to participate in the Offering.

Sanu owns three highly attractive gold exploration permits in Guinea, located within the Siguiri Basin in proximity to AngloGold Ashanti’s Siguiri gold mine, Nordgold’s Lefa gold mine, Predictive Discovery’s Bankan gold project, and exploration tenements held by Endeavour Mining. Sanu is currently undertaking a 10,000-meter drill programme at its Diguifara and Daina properties, comprising of up to 120 holes, where historical exploration efforts resulted in the identification of a number of mineralised gold-bearing structures. Sanu expects to use the net proceeds of the Offering to advance exploration, including geophysics and drilling on the company’s Daina, Diguifara and Bantabaye gold exploration permits, and for general and administrative purposes.

Martino De Ciccio, CEO of Montage, commented: “We are very pleased to form a strategic partnership with Sanu Gold, owner of a highly prospective exploration portfolio in Guinea’s Siguiri Basin, which will allow Montage to leverage Sanu’s established presence in the country to accelerate its greenfield exploration strategy. Furthermore, we are pleased to invest alongside the Lundin Family and existing shareholders such as AngloGold Ashanti. Based on our prudent capital allocation framework, our strategic investment follows a thorough review of potential partnerships in West Africa in addition to technical due diligence. We look forward to working alongside the Sanu team to rapidly unlock exploration value for the benefit of all stakeholders.

We continue to be pleased with the strong momentum generated across our business and look forward to unlocking significant exploration value at our flagship Koné project, in addition to sourcing future growth through greenfield exploration success. In line with this objective and further to evaluating strategic partnerships, we have also made considerable progress to stake highly prospective exploration grounds in Côte d’Ivoire, to reinforce our presence in the country and leverage the expertise of our well-established exploration team.”

Martin Pawlitschek, President and CEO of Sanu commented: “Sanu is excited to attract the strategic investment of both Montage, an emerging West African gold producer and the Lundin family to its share register. Montage leadership is comprised of seasoned West African gold professionals and this further highlights the potential of Sanu’s projects in Guinea. We welcome Martino as Chair to the Sanu board of directors and Silvia to our new joint-technical committee, and we are confident that the relationship with Montage will bring added value to Sanu’s exploration projects. We look forward to working with Montage and the Lundin Family, along with our existing strategic investors in unlocking significant discoveries in Guinea.”

Key terms of the Strategic Partnership

Montage has entered into a binding term sheet in respect of a transaction (the “Share Exchange Transaction”) whereby Montage and Sanu will enter into an Investment Agreement and Investor Rights Agreement, which will persist so long as Montage holds at least 10% of the issued and outstanding Sanu Common Shares (the “Investor Rights Agreement Threshold”), with the following key terms:

- Equity Swap: Montage will obtain a 19.9% ownership in Sanu, through a Share Exchange Transaction which results in the issuance of 76,307,155 Sanu Common Shares to Montage, and the issuance of 2,337,921 common shares of Montage (“Montage Shares”) to Sanu equating to a 0.67% ownership in Montage, for a total implied transaction consideration of C$5,494,115. The Share Exchange Transaction is based on a Montage share price of C$2.35 (corresponding to the 30-day VWAP) and a Sanu share price of C$0.072 (representing a 4% premium to the 30-day VWAP). Montage Shares will be issued to Sanu under an exemption from the prospectus requirements of applicable Canadian securities laws and will be subject to a hold period of four months and one day from the date of issuance to Sanu. Any Sanu sale of Montage shares will be subject to certain notice rights to enable Montage Gold to designate suitable purchaser(s), subject to the Investor Rights Agreement Threshold.

- Participation Rights: Right to participate in future equity issuances and top-up rights to maintain Montage’s ownership percentage in Sanu, payable in Montage shares, cash, or a combination of either.

- Board Nominee: Appointment of a Montage nominee as Chairman to the Board of Directors of Sanu. As such, on closing of the Share Exchange Transaction, Martino De Ciccio, CEO of Montage, will be appointed as Non-Executive Chairman of the Board of Directors of Sanu.

- Joint-Technical-Committee: Appointment of Silvia Bottero, EVP Exploration at Montage, to a newly formed joint-technical-committee with Sanu on the Daina and Bantabaye properties.

- Right of First Refusal (“ROFR”): On certain asset-level transactions for Daina and Bantabaye. Furthermore, the ROFR includes any new properties acquired by Sanu subject to the Investor Rights Agreement Threshold.

Pursuant to the existing investor rights agreement between AngloGold Ashanti and Sanu, AngloGold Ashanti will be entitled to acquire Sanu Common Shares in connection with the Share Exchange Transaction and Offering on equivalent terms to maintain its pro rata equity interest in Sanu. The Offering includes an allocation of Sanu Common Shares to AngloGold Ashanti to maintain this pro rata equity interest and in the event AngloGold Ashanti elects not to exercise its right, the allocation will be distributed to other investors.

The Share Exchange Transaction and the Offering are expected to close in the coming weeks.

ABOUT SANU GOLD CORP.

As shown in Figure 1 below, Sanu Gold owns the Daina, Diguifara and Bantabaye exploration properties located within the Siguiri Basin in Guinea, West Africa. Sanu currently holds a 75% interest in each of the three properties, which remain subject to earn-in agreements. Sanu retains the right to acquire up to 85% of each of the properties. The three properties are adjacent to established mining infrastructure and high-quality, multi-million ounce deposits and producing gold mines.

Figure 1: Location of Sanu Gold’s properties in the Siguiri Basin

Source: Sanu Gold Corp.

About the Daina property

The Daina property hosts a high-grade gold discovery located to the northeast of the Siguiri Basin. The combined >10km strike length structures includes three-high priority targets which, to date, remain mostly undrilled, and are situated north and along trend of properties held by AngloGold Ashanti. The Daina 2 Main Zone target was subject to initial drilling and remains open at depth and along strike. IP geophysics orientation surveys were successfully complete to inform the current drill-programme.

Historical drilling on the Daina 2 Main Zone target includes the following intercepts:

- 15m at 5.48 g/t Au (incl. 2m at 78.4 g/t Au)

- 21m at 4.75 g/t Au (incl. 1m at 85.5 g/t Au)

- 37m at 1.99 g/t Au (incl. 1m at 32.6 g/t Au and 1m at 15.0 g/t Au)

- 11m at 5.50 g/t Au (incl. 1m at 56.6 g/t Au)

Sanu does not have sufficient information to make a determination of the true widths of the drill hole intercepts reported from Diana to date.

For additional information on Daina, see Sanu’s news releases dated October 3 and 18, 2022.

About the Diguifara property

The Diguifara property hosts a >8km gold corridor with a number of targets within trucking distance to AngloGold Ashanti’s Siguiri gold mine, located approximately 20km to the southwest. Sanu has established a joint-technical-committee in September 2024 with strategic investor, AngloGold Ashanti, to advance the property. Extensive surface gold anomalies following the same regional structures as other major gold mines in the area have, to date, assisted in identifying three high-priority drill targets along the >8km strike length.

About the Bantabaye property

The Bantabaye property hosts a large mineralised system within a highly attractive structural setting. The property is located close to well-known deposits including NordGold’s Lefa gold mine and Predictive Discovery’s Bankan gold project. Positive initial test work conducted by Sanu indicate gold recoveries of 92-93%. The property’s Target 2 is mineralised over at least 500 meters along strike and 120 meters down dip, remaining open in all directions.

Historical intercepts on the Target 2 includes intercepts of:

- 15m at 11.4 g/t Au (incl. 4m at 41.2 g/t Au) from RC Hole BANT-RC-002

- 14m at 1.94 g/t Au (incl 1m at 29.89 g/t Au) from RC Hole BANT-RC-048

- 80m at 1.46 g/t Au (incl. 7m at 4.1 g/t Au and 3m at 8.43 g/t Au) from Trench BANT-TR05

Sanu does not have sufficient information to make a determination of the true widths of the drill hole intercepts reported from Bantabaye to date.

For further information on Bantabaye, see Sanu news releases date July 27, 2023 and November 16, 2023, as well as the “Technical Report NI 43-101 for Banta Baye Gold Project, Republic of Guinea” with an effective date of May 30, 2022 and filed on the Sanu’s SEDAR profile on May 31, 2022. Montage accepts no responsibility for the adequacy or accuracy of information or disclosures from Sanu.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

ABOUT MONTAGE GOLD CORP.

Montage Gold Corp. (TSXV: MAU) is a Canadian-listed company focused on becoming a premier multi-asset African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Feasibility Study published in 2024, the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years. Over the course of 2024, the Montage management team will be leveraging their extensive track record in financing and developing projects in Africa to progress the Koné project towards a construction launch.

TECHNICAL DISCLOSURE

Mineral Resource and Reserve Estimates

The Koné and Gbongogo Main Mineral Resource Estimates were carried out by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Western Australia, who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43–101.

The Mineral Reserve Estimate was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd., who is considered to be independent of Montage Gold. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under NI 43–101.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release related to Montage have been verified and approved by Silvia Bottero, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mrs. Bottero, EVP Exploration of Montage, is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (SACNASP), a member of the Geological Society of South Africa and a Member of AusIMM.

CONTACT INFORMATION

| For Investor Relations Inquiries: Jake Cain Strategy & Investor Relations Manager jcain@montagegold.com +44 7788 687 567 | For Media Inquiries: John Vincic Oakstrom Advisors john@oakstrom.com +1-647-402-6375 | For Regulatory Inquiries: Kathy Love Corporate Secretary klove@montagegold.com +1-604-512-2959 |

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the timing and amount of future production from the Koné Gold Project; and anticipated mine life of the Koné Gold Project.

Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that any Forward-looking Statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties inherent in the preparation of mineral reserve and resource estimates and definitive feasibility studies such as the Mineral Reserve Estimate and the UFS, and in delineating new mineral reserve and resource estimates, including but not limited to, assumptions underlying the production estimates not being realized, incorrect cost assumptions, unexpected variations in quantity of mineralized material, grade or recovery rates being lower than expected, unexpected adverse changes to geotechnical or hydrogeological considerations, or expectations in that regard not being met, unexpected failures of plant, equipment or processes, unexpected changes to availability of power or the power rates, failure to maintain permits and licenses, higher than expected interest or tax rates, adverse changes in project parameters, unanticipated delays and costs of consulting and accommodating rights of local communities, environmental risks inherent in the Côte d’Ivoire, title risks, including failure to renew concessions, unanticipated commodity price and exchange rate fluctuations, delays in or failure to receive access agreements or amended permits, and other risk factors set forth in the Company’s 2023 Annual Information form available at www.sedarplus.ca, under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c0fb3683-c781-4871-903c-ae29261856c6

© Copyright Globe Newswire, Inc. All rights reserved. The information contained in this news report may not be published, broadcast or otherwise distributed without the prior written authority of Globe Newswire, Inc.